Lecture 12:

DATA 101: Making Prediction with Data

University of British Columbia Okanagan

Introduction

- In the last lecture we saw how we could fit the KNN classification models using tidymodels.

- Recall: tidymodels is an R package and framework for modeling that follows the principles of the tidyverse.

- In the upcoming lectures we will continue to work with tidymodels to tackle the regression problem

- In other words, we focus on predicting numeric variables in contrast to previous lectures which concentrated on predicting a categorical variable (classification problem).

Similarities with Classification:

- Regression, like classification, is a predictive problem setting where we want to use past information to predict future observations.

- Just like in the classification setting, there are many possible methods that we can use to predict numerical response variables.

- In this chapter we will focus on the K-nearest neighbors (KNN) algorithm

Regression vs. Classification

Goal of Classification: predict a categorical or discrete label or class.

Example applications: spam detection, image recognition , sentiment analysis, and medical diagnosis. The output is often a class label, and the model’s objective is to assign input data points to the correct class.

Goal of Regression: predict a continuous or numeric value.

Example applications: predicting house prices based, forecasting stock prices, estimating a person’s age from facial features, and predicting a person’s income based on various factors.

Similarity of methods

While this lecture will tackle a different mode of problems, the following will be the same:

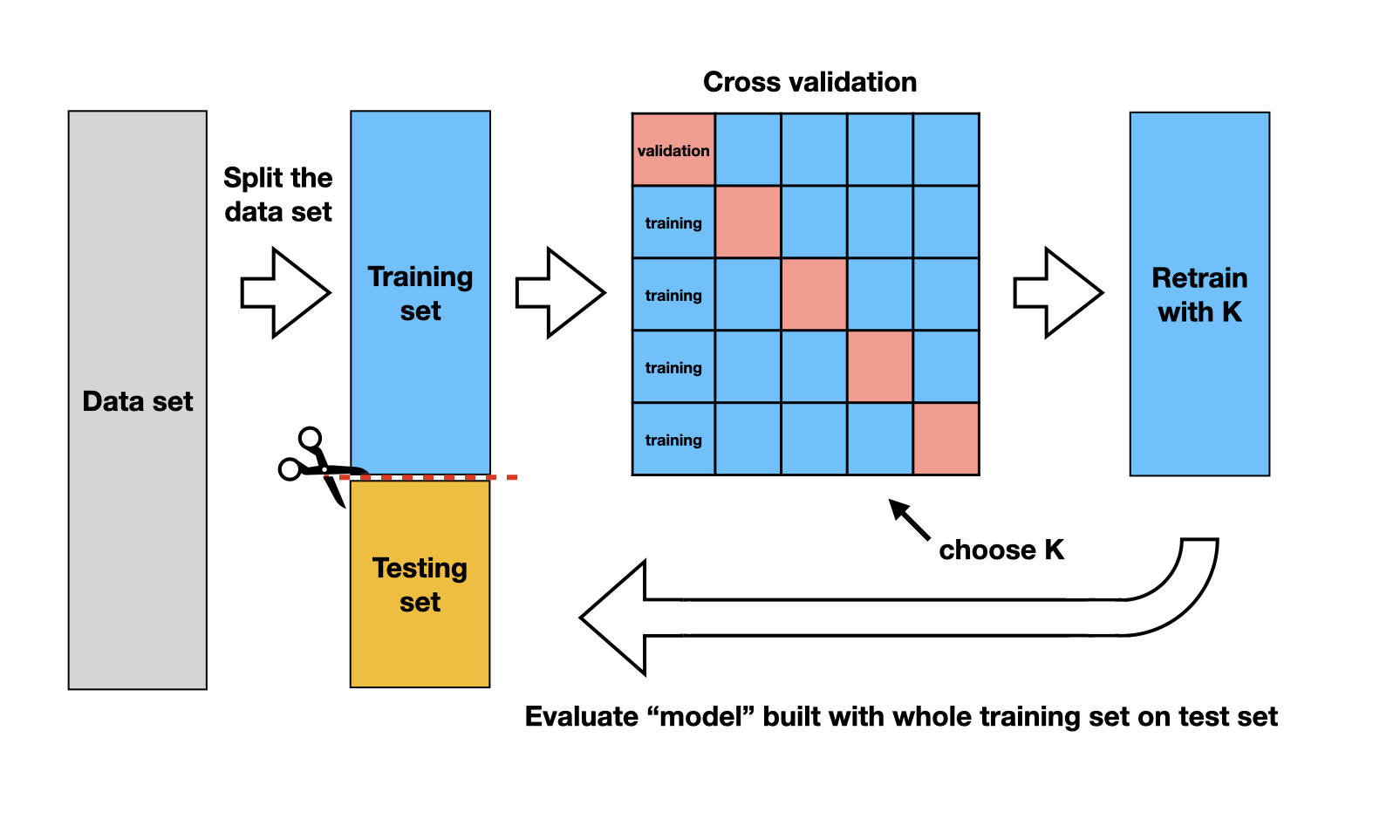

- Data splitting into training, validation, and test sets.

- Utilization of tidymodels workflows for a structured approach.

- Adoption of K-nearest neighbors (KNN) for making predictions.

- Implementation of cross-validation for hyperparameter tuning.

KNN for regression

- Many of the concepts from classification map over to the setting of regression.

- For example, a regression model predicts a new observation’s response variable based on the response variables for similar observations in the training set (as indicated in the nearest neighbourhood)

- As before the best choice for the number of nearest neighbours to choose from will be determined by cross-validation (CV)

Data

We will study a data set of real estate transactions originally reported in the Sacramento Bee newspaper. [Source]

It comprises 932 transactions in Sacramento, California over a five-day period

Data

Motivating Question

- Our question is again predictive: Can we use the size of a house in the Sacramento, CA area to predict its sale price?

- A rigorous, quantitative answer to this question might help a realtor advise a client as to whether the price of a particular listing is fair, or perhaps how to set the price of a new listing.

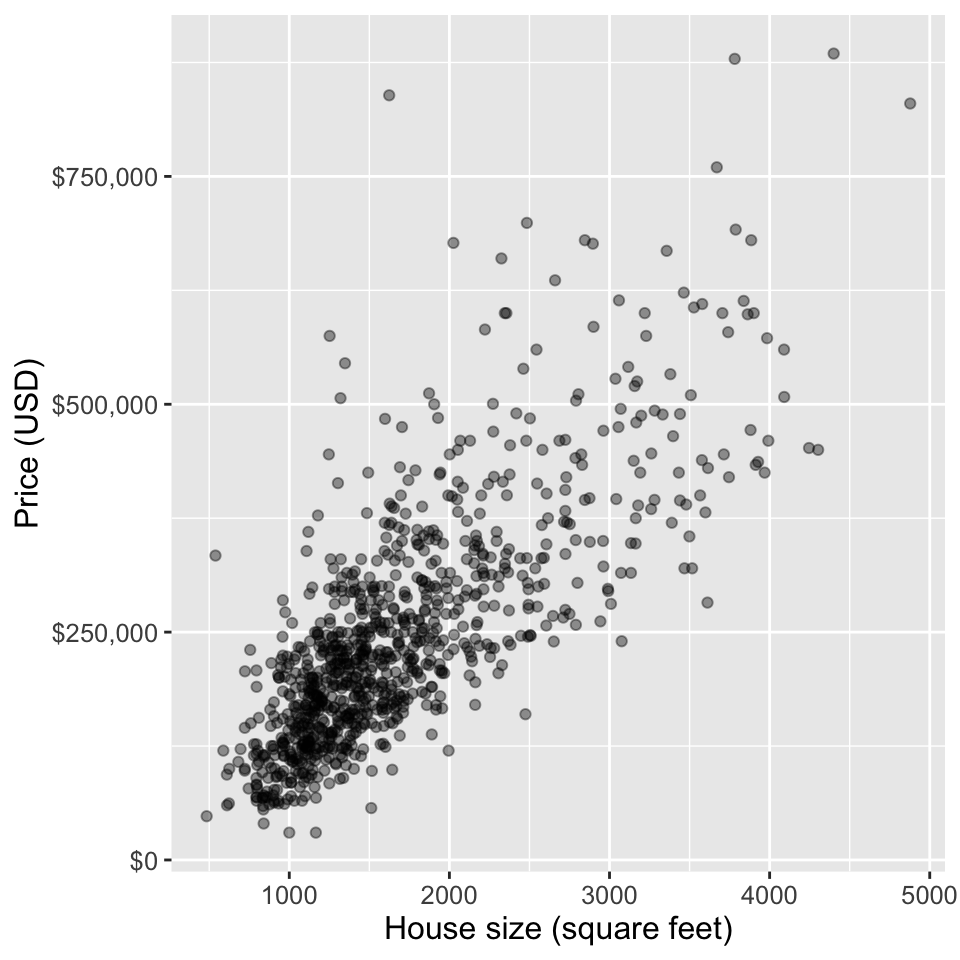

Exploratory Data Analysis

- For our initial exploration, let’s investigate the relationship between

sqft(house size, in livable square feet) andprice(house sale price, in US dollars (USD)). - Let’s create a scatter plot with the predictor variable (house size) on the x-axis, and we place the response variable that we want to predict (sale price) on the y-axis.

Scatterplot

- We can see that in Sacramento, CA, as the size of a house increases, so does its sale price.

- Thus, we can reason that we may be able to use the size of an unsold to predict its final sale price.

K-Nearest Neighbour Regression

Much like in the case of classification, we can use a K-nearest neighbors-based approach in regression to make predictions.

- Select the number

Kof the neighbors. - Find the

Knearest1 neighbors - Compute the average

priceamong theseKneighbors

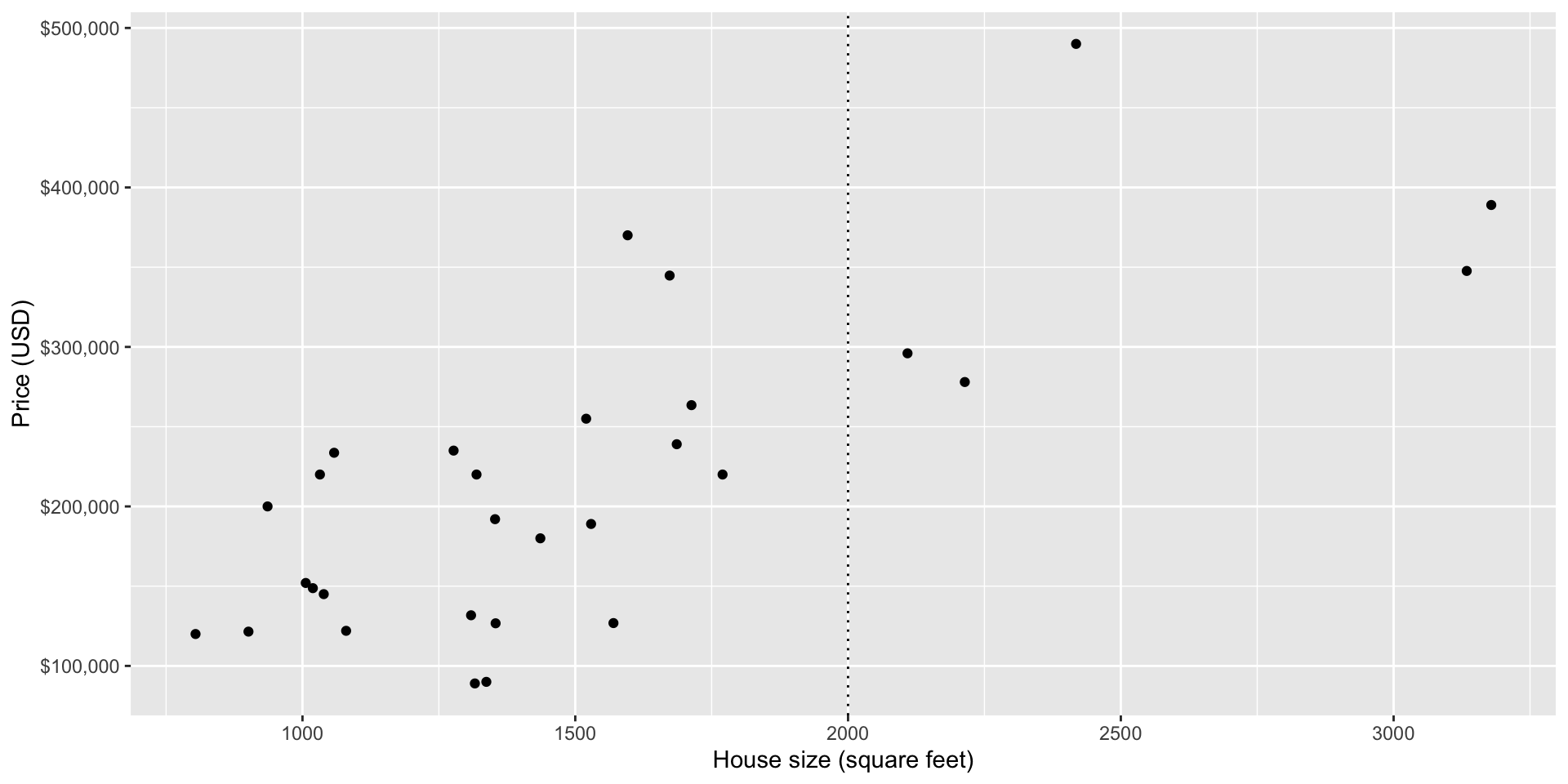

Let’s take a small sample of the data to illustrate the mechanics of KNN regression …

Random Sample

- To take a small random sample of size 30, we’ll use the function

slice_sample, and input the data frame to sample from and the number of rows to randomly select.

- Based on the sample data above, what would we predict the selling price of a 2000 square foot house?

Small plot

The geom_*line geoms add reference lines (sometimes called rules) to a plot, either horizontal (geom_hline), vertical (geom_vline), or diagonal (geom_abline) (specified by slope and intercept).

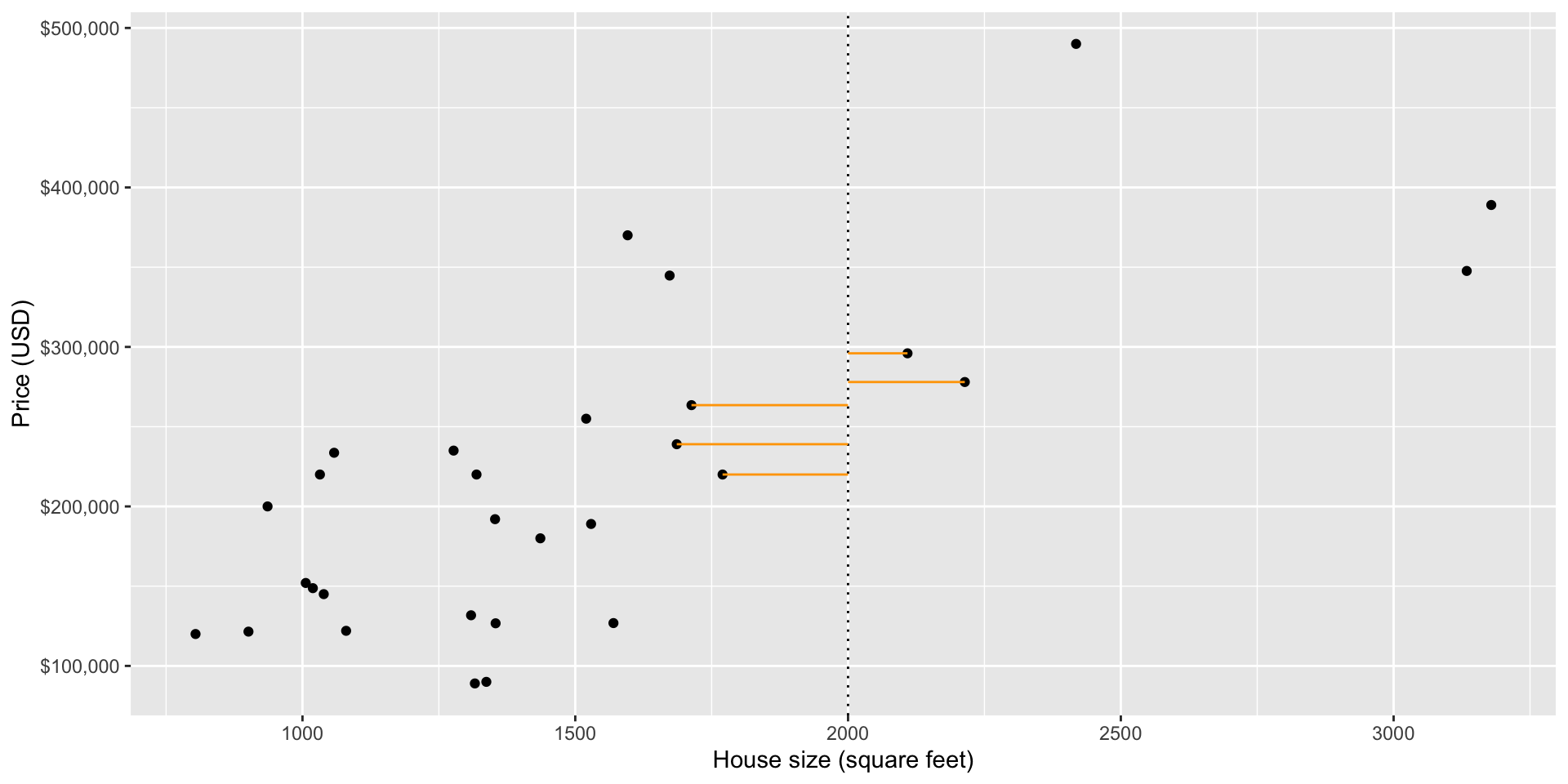

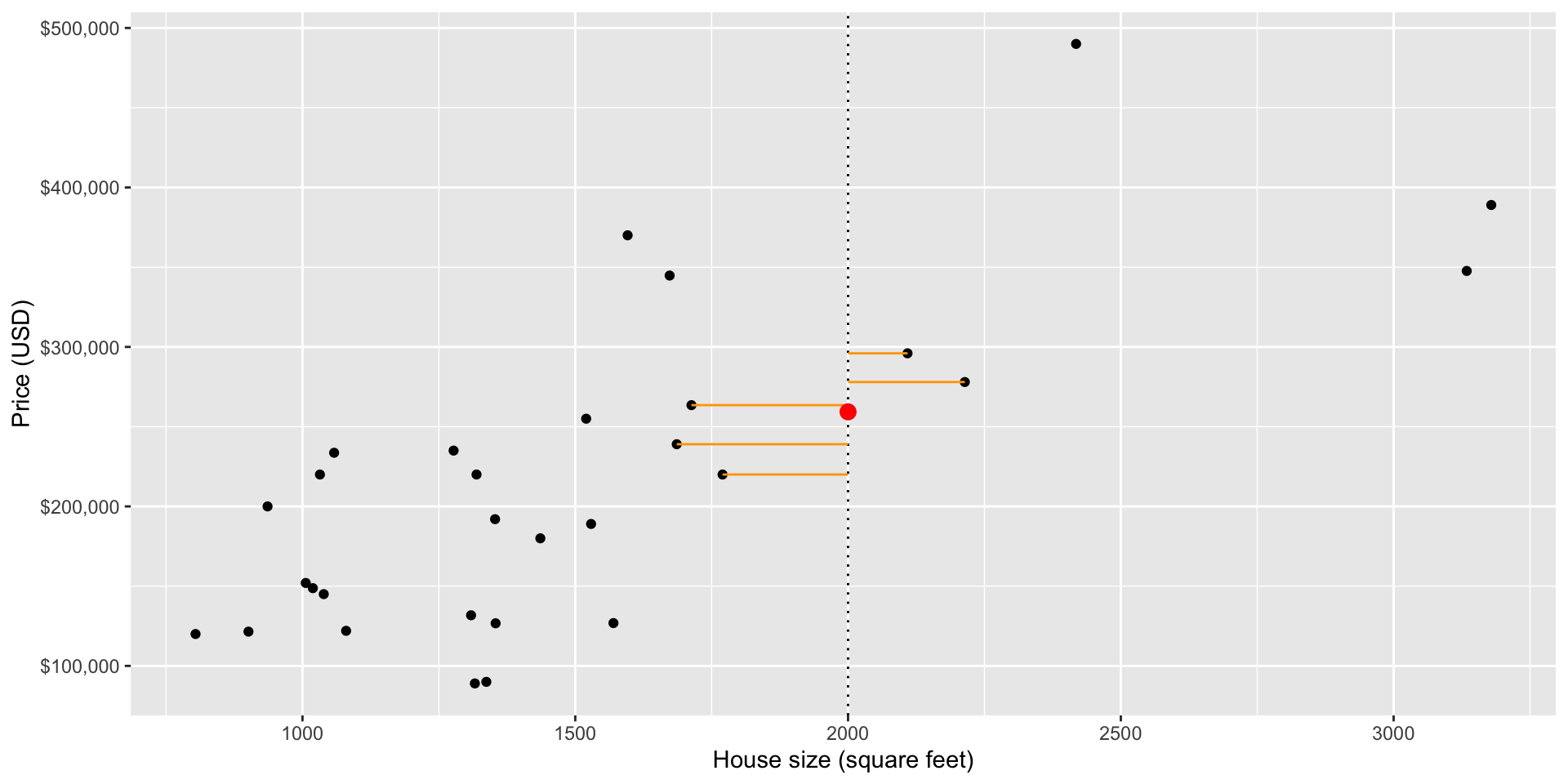

Nearest Neighbours

Suppose we were employing KNN regression with K = 5 (we’ll come back to this later)

Nearest Neighbours

Prediction

- We would employ intuition from the classification chapter, and use the neighboring points to the new point of interest to suggest/predict what its sale price might be.

The predicted price for a house with 2000 square footage, is the average price of it’s five nearest neighbours:

Predicted price

Choosing K

As with KNN classification, in KNN regression we still have the same question of how we best choose

K, the number of nearest neighbours.Luckily for, the answer is the same: we use cross-validation to tune the model

This will provide some guidance as to the optimal choice of our tuning parameter

K

Steps for fitting the model

- Split into training and test set

- Preform cross validation to determine

K - Retain the model with this chosen

K - Evaluate how we did on the test set

Training/Test set

The above splits the data frame into 75% training and 25% test.

- Numeric strata are binned into quartiles1

- Hence there will be roughly the same proportion of houses in each of these four bins in both the training and testing set.

Cross Validation

Next, we’ll use cross-validation to choose

KIn KNN classification, we used accuracy to see how well our predictions matched the true labels.

We cannot use the same metric in the regression setting, since our predictions will almost never exactly match the true response variable values.

Therefore in the context of KNN regression we will need a different metric …

RMPSE

For KNN regression the evaluation metric that we will use to quantify the performance of the model is the root mean square prediction error (RMSPE) given by:

\[\begin{equation} \text{RMSPE} = \sqrt{\frac{1}{n}\sum\limits_{i=1}^{n}(y_i - \hat{y}_i)^2} \end{equation}\]\(n\) is the number of observations,

\(y_i\) is the observed value for the \(i^{th}\) observation, and

\(\hat y_i\) is the forecasted/predicted value for the \(i^{th}\) observation.

Note that this is computed over unseen data points (either our test or validation set)

Terminology Alert

You textbook makes the distinction between calculating this metric on the training set, vs a testing/validation set (aka out-of-sample predictions)

Prediction error on the test/validation set: \[\begin{equation} \text{RMSPE} = \sqrt{\frac{1}{n}\sum\limits_{i=1}^{n}(y_i - \hat{y}_i)^2} \end{equation}\] where \(\hat y_i\) our out-of-sample predictions.

The prediction error on the training set: \[\begin{equation} \text{RMSPE} = \sqrt{\frac{1}{n}\sum\limits_{i=1}^{n}(y_i - \hat{y}_i)^2} \end{equation}\] where \(\hat y_i\) our in-sample predictions.

Warning

Many places use RMSE for both, and rely on context to denote which data the root mean squared error is being calculated on.

Recipe

First, we will create a recipe for preprocessing our data.

This will normalize our predictor to have a mean of 0 and standard deviation of 1.

Note

Note that we include standardization in our preprocessing to build good habits, but since we only have one predictor, it is technically not necessary; there is no risk of comparing two predictors of different scales.

Model Specification

Next we create a model specification for K-nearest neighbors regression.

Note that we use set_mode("regression") now in the model specification to denote a regression problem, as opposed to the classification problem.

Cross Validation Workflow

Then we create a cross-validation object (we will use 5-fold), and put the recipe (sacr_recipe) and model specification (sacr_spec) together using workflow().

Cross Validation Workflow

══ Workflow ════════════════════════════════════════════════════════════════════

Preprocessor: Recipe

Model: nearest_neighbor()

── Preprocessor ────────────────────────────────────────────────────────────────

2 Recipe Steps

• step_scale()

• step_center()

── Model ───────────────────────────────────────────────────────────────────────

K-Nearest Neighbor Model Specification (regression)

Main Arguments:

neighbors = tune()

weight_func = rectangular

Computational engine: kknn CV grid

- Next we run CV for a grid of candidate values for

K - While

Kcould be any integer from 1 to 698 (number of observations in our training set), we will thin out this vector and try every third number ranging from 1 to 200.

CV grid

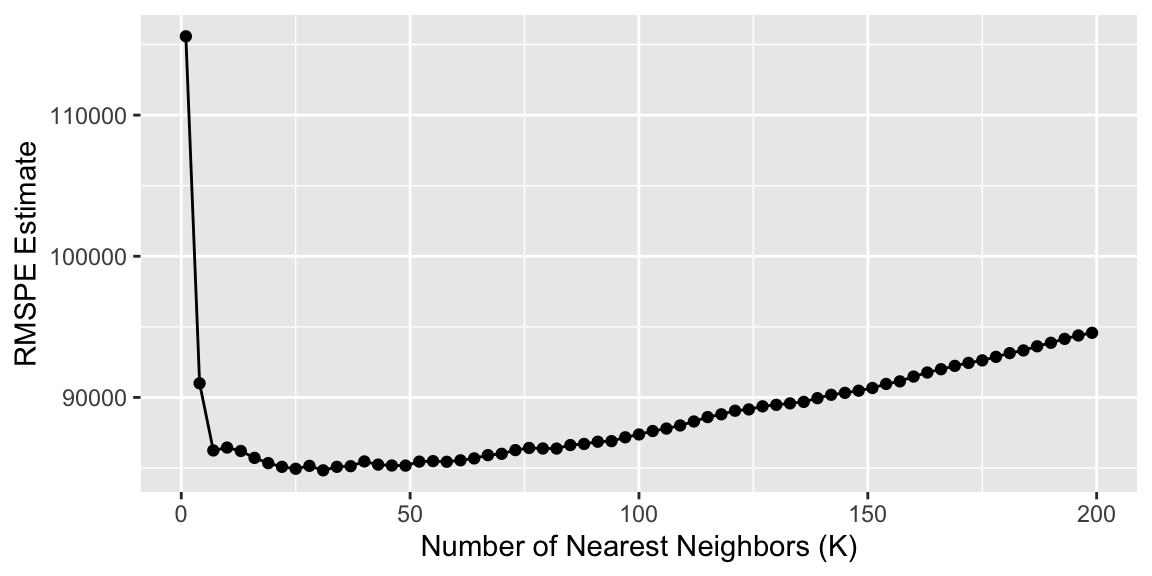

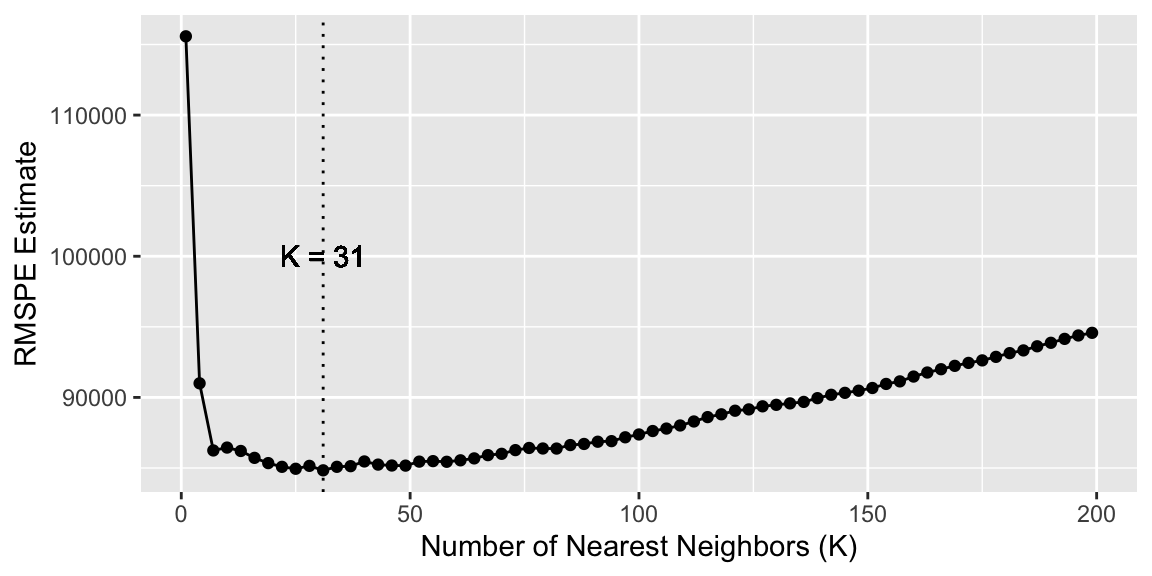

CV plot

Best K

Since it’s a little bit hard to tell on the plot where the minimum lies, let’s find automate it:

CV plot

The smallest RMSPE occurs when K = 31

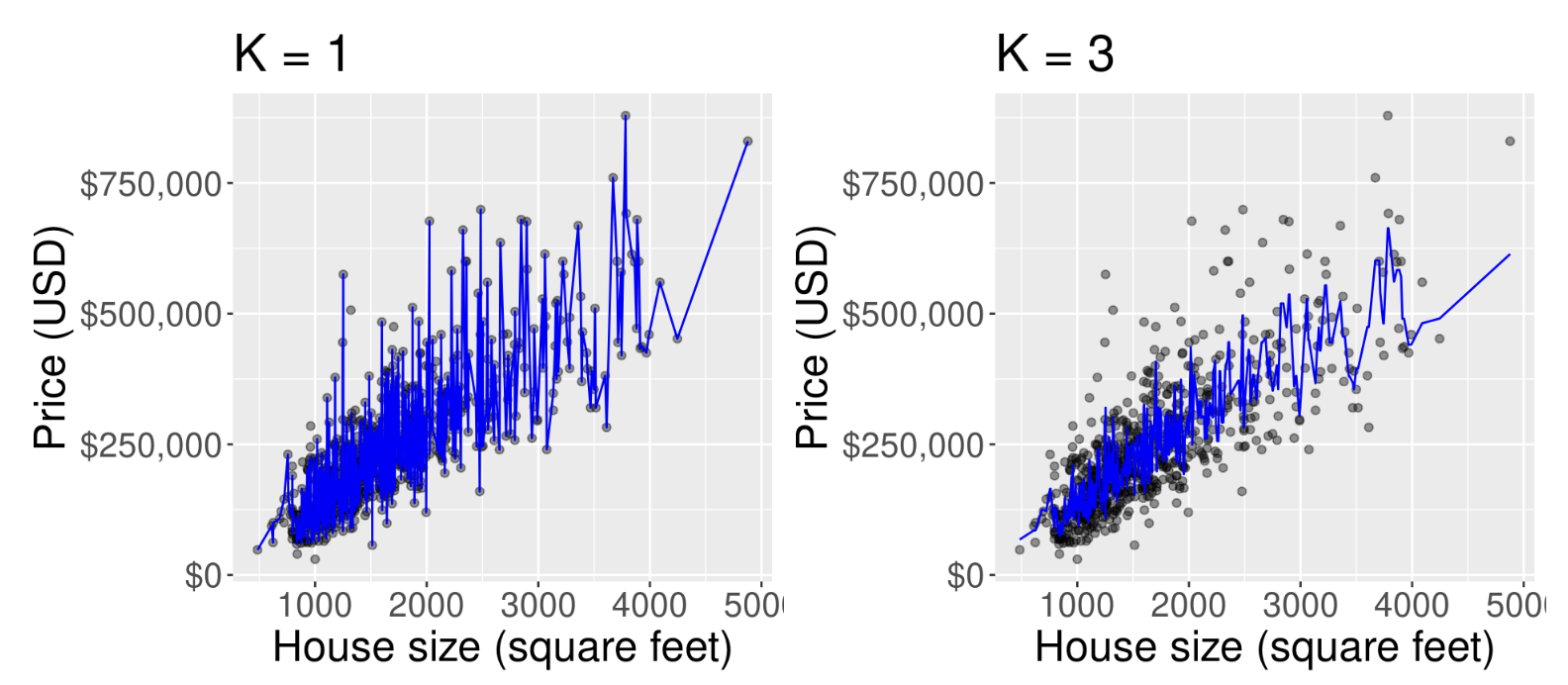

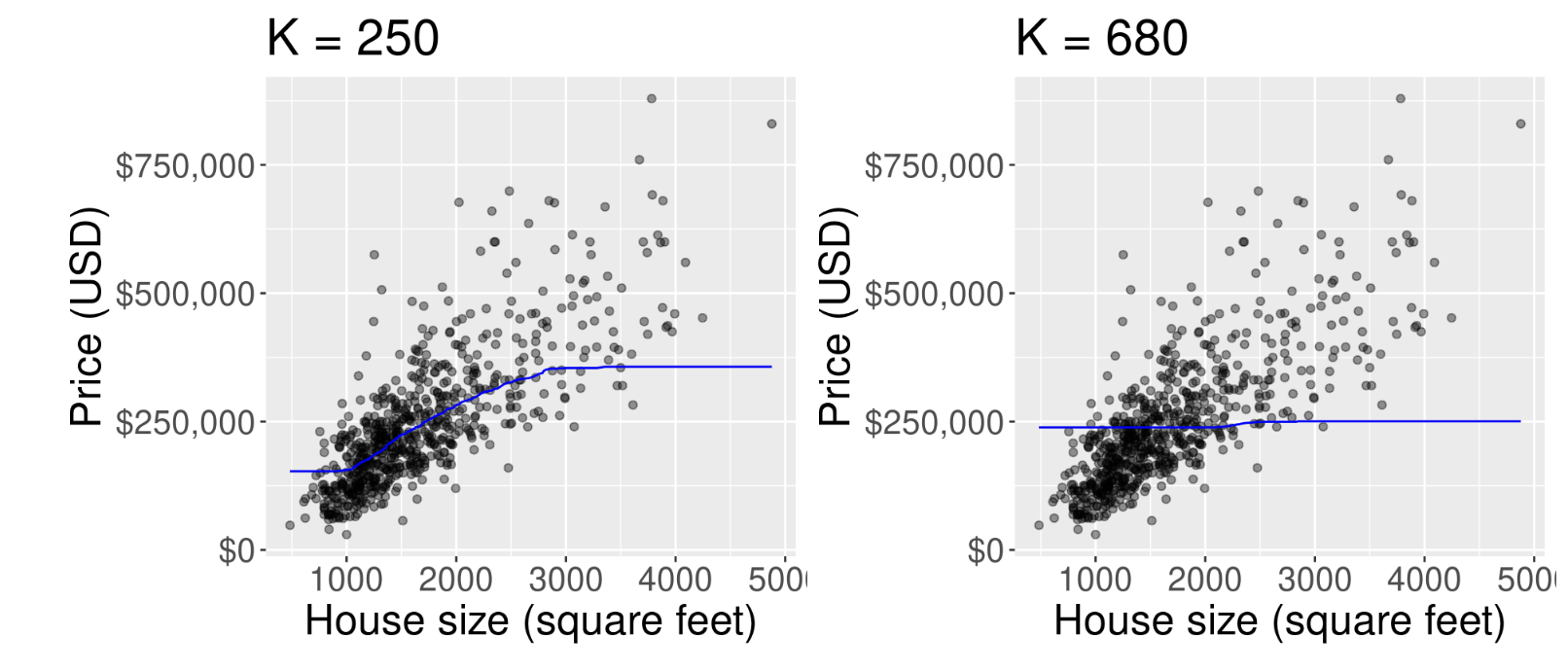

Bad Ks

As in the classification setting, if we choose a

Kthat is too small (e.g.K= 4) we would expect the error of our model to go up.Similarly, if we choose a value of

Kthat is too big (e.g.K= 200) we would expect the error of our model to go up.Let’s visualizes the effect of different settings of the number of neighbors on the regression model …

K too small

The predicted values for house sale price for a KNN regression model fitted on the training data with K = 1 (left) and K = 3 (right).

Overfitting

- In general, when

Kis too small, the model captures the noise and random fluctuations in the training data, rather than the underlying patterns and trends. - In other words, the line follows the training data too closely.

- This leads to poor predictive performance on new data because the model has essentially memorized the training data rather than learning the underlying relationships.

- This behavior—where the model fits the training data extremely closely but doesn’t generalize well to unseen or new data—is called overfitting

K too big

The predicted values for house sale price for a KNN regression model fitted on the training data with K = 250 (left) and K = 380 (right).

Underfitting

- In general, when

Kis too large, the model is not influenced enough by the training data! - In other words this model is not flexible enough to capture the underlying patterns in the data

- This results in poor performance both on the training data and on new, unseen data.

- This behavior—when a model is too simplistic to capture the underlying patterns in the data—is called underfitting

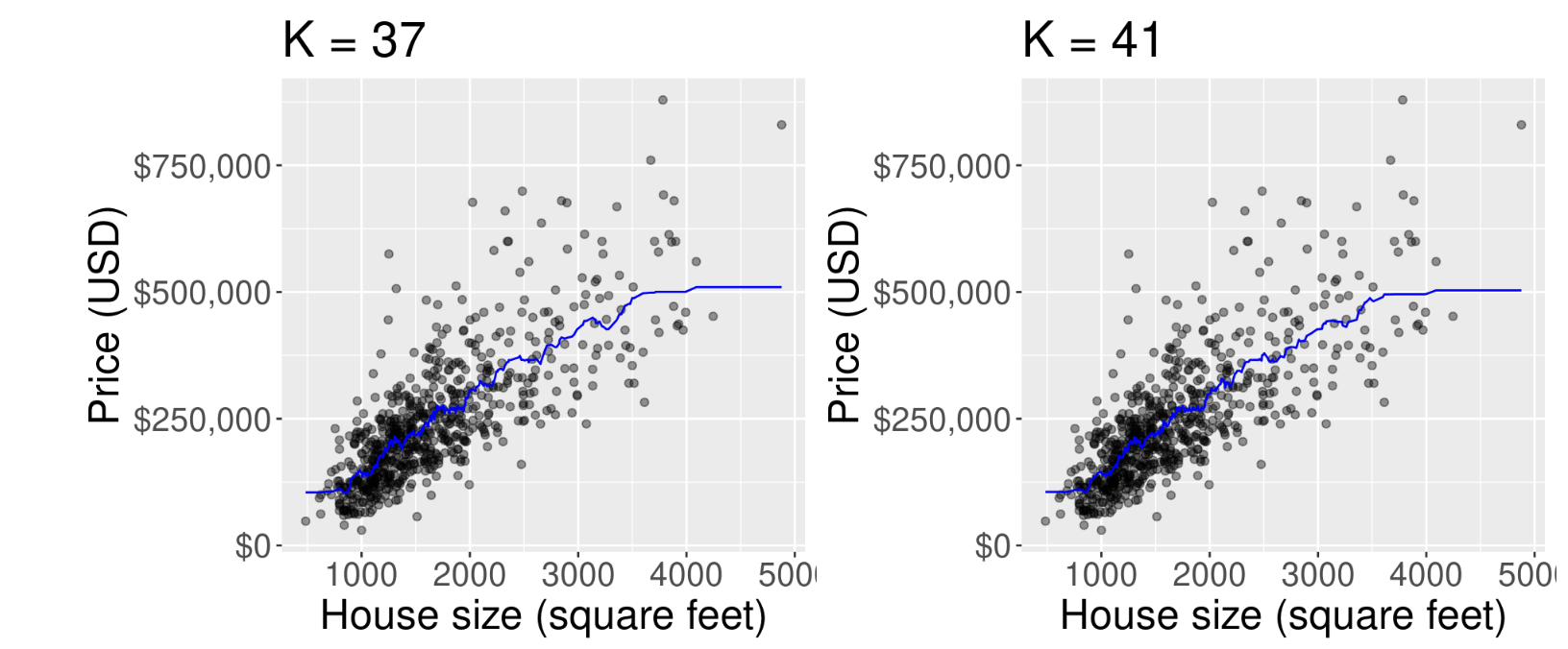

Sweet spot

-

Ideally, what we want is neither of the two situations discussed above. Instead, we would like a model that

- follows the overall “trend” in the training data, so the model actually uses the training data to learn something useful, and

- does not follow the noisy fluctuations, so that we can be confident that our model will transfer/generalize well to other new data.

We can see that other values for K achieves this goal \(\dots\)

Optimal K

The predicted values for house sale price for a KNN regression model fitted on the training data with K = 37 (left) and K = 41 (right).

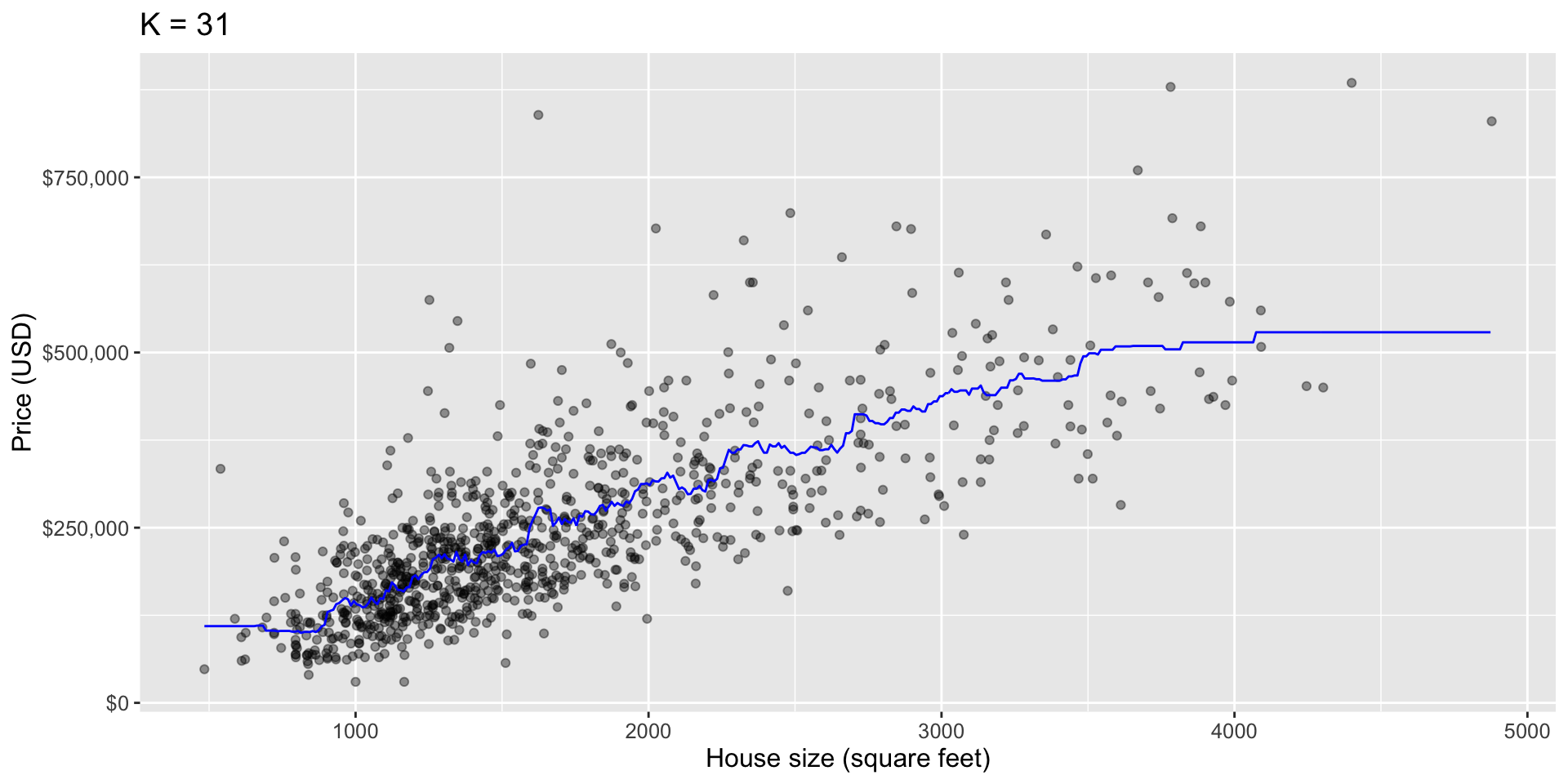

Our best model

Let’s explore the fit which our CV deemed best

Note that our best

Kis slightly different than the textbook since we are not using the same seed!To do this, we will first re-train our KNN regression model on the entire training data set, using

K= 31 neighbors.

Retraining the model

Evaluate our model on the test set

To quantify the performance of our fitted model we compute its RMSPE on the test data.

Comment

- Our final model’s test error as assessed by RMSPE is $86813.53 (this measured in the same units as the response variable).

- In other words, on new observations, we expect the error in our prediction to be roughly $86813.53.

- In this application, this error is not prohibitively large, but it is not negligible either; $86813.53 might represent a substantial fraction of a home buyer’s budget.

Predictions of our fitted model

The following code calculates the predictions that our final model makes across the range of house sizes we might encounter in the Sacramento area (roughly 500 to 5000 square feet).

As a coding challenge, go through this code on your own time to reproduce the plot

Code

# range of plausible house sizes

sqft_prediction_grid <- tibble(

sqft = seq(

from = sacramento |> select(sqft) |> min(),

to = sacramento |> select(sqft) |> max(),

by = 10

)

)

# predicted price of these hypothetical houses

sacr_preds <- sacr_fit |>

predict(sqft_prediction_grid) |>

bind_cols(sqft_prediction_grid)

# scatter plot of price vs. square footage

plot_final <- ggplot(sacramento, aes(x = sqft, y = price)) +

geom_point(alpha = 0.4) +

# superimpose prediction line

geom_line(data = sacr_preds,

mapping = aes(x = sqft, y = .pred),

color = "blue") +

xlab("House size (square feet)") +

ylab("Price (USD)") +

scale_y_continuous(labels = dollar_format()) +

ggtitle(paste0("K = ", kmin)) +

theme(text = element_text(size = 12))

plot_finalPredictions of our fitted model

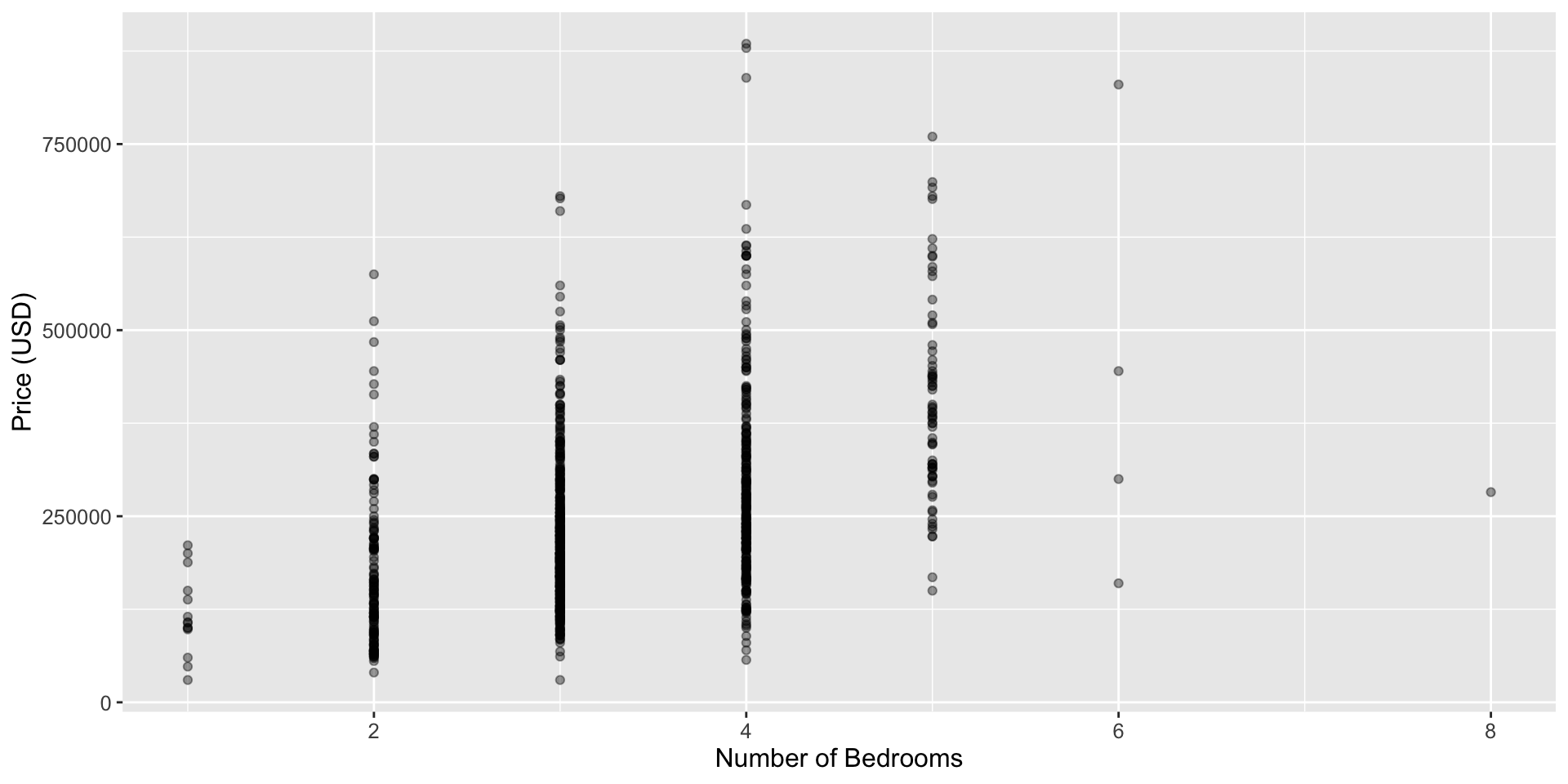

Multivariable KNN

For both KNN classification and KNN regression we can use multiple predictors in our model.

For instance, the number of bedrooms (

beds) and bathrooms (baths) may prove to be useful predictors in determining the selling price (price).We can very easily adjust our code to include more than one predictor.

Warning

Warning

Having more predictors is not always better

- To demo multivariate KNN we we will use house size (measured in square feet) as well as number of bedrooms as our predictors.

- If we want to compare this multivariable KNN regression model to the model with only a single predictor, then we can compare the accuracy estimated using only the training data via cross-validation.

EDA bedrooms

Recipe + Specfication

CV for choosing K

Multivariate KNN results

- Here we see that the smallest estimated RMSPE from cross-validation occurs when

K= 10 - Looking back, the estimated cross-validation accuracy for the single-predictor model was $86813.53,227.

- The estimated cross-validation accuracy for the multivariable model is $85034.51.

- Thus in this case, we did not improve the model by a large amount by adding this additional predictor.

Comments

Kthat gives us the smallest RMSPE.